Debt-To-Equity Ratio: What it is and How to Calculate it

The D/E ratio contains some ambiguity because a healthy D/E ratio often falls within a range. It may not always be clear to an investor whether the D/E ratio is, in fact, too high or low. One limitation of the D/E ratio is that the number does not provide a definitive assessment of a company. In other words, the ratio alone is not enough to assess the entire risk profile. It’s also helpful to analyze the trends of the company’s cash flow from year to year.

How Can the Debt-to-Equity Ratio Be Used to Measure a Company’s Risk?

Very high D/E ratios may eventually result in a loan default or bankruptcy. What counts as a “good” debt-to-equity (D/E) ratio will depend on the nature of the business and its industry. Generally speaking, a D/E ratio below 1 would be seen as relatively safe, whereas values of 2 or higher might be considered risky. Companies in some industries, such as utilities, consumer staples, and banking, typically have relatively high D/E ratios. Business owners use a variety of software to track D/E ratios and other financial metrics.

- The debt-to-equity ratio is one of the most important financial ratios that companies use to assess their financial health.

- Whether evaluating investment options or weighing business risks, the debt to equity ratio is an essential piece of the puzzle.

- Last, the debt ratio is a constant indicator of a company’s financial standing at a certain moment in time.

- For every dollar in shareholders’ equity, the company owes $1.50 to creditors.

What Does a Negative D/E Ratio Signal?

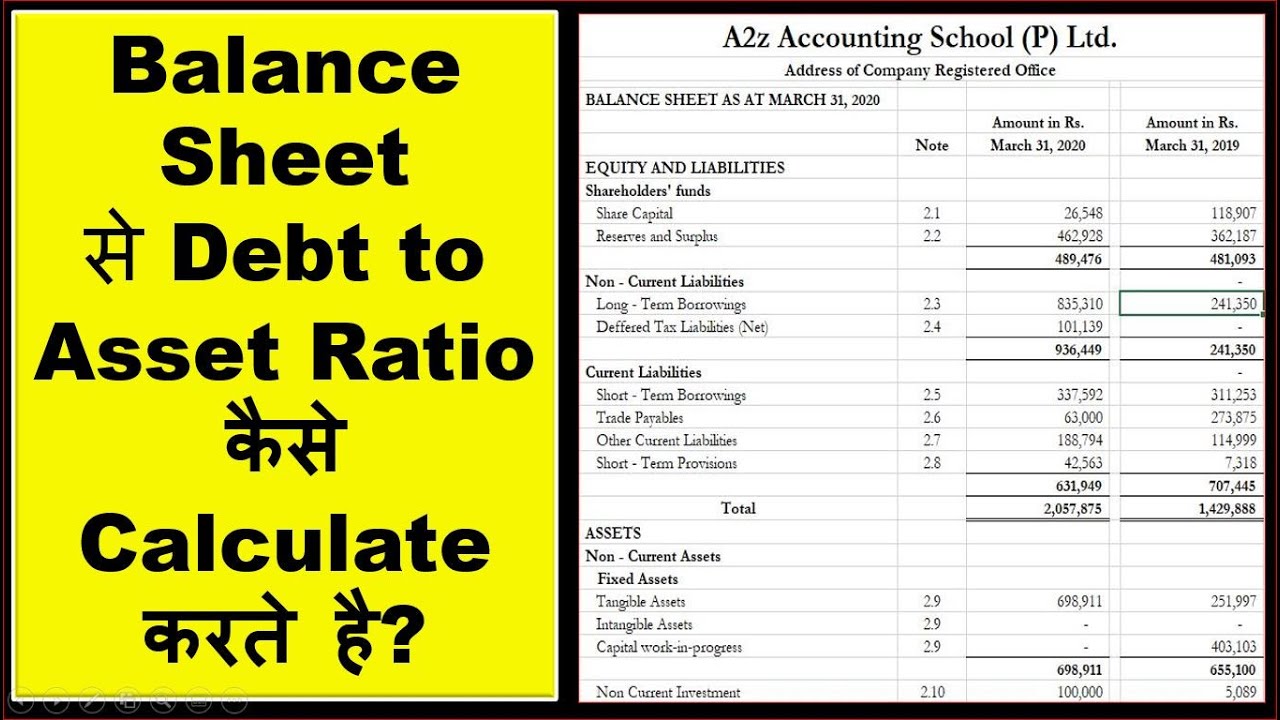

From the above, we can calculate our company’s current assets as $195m and total assets as $295m in the first year of the forecast – and on the other side, $120m in total debt in the same period. Investors can use the debt-to-equity ratio to help determine potential risk before they buy a stock. As an individual investor you may choose to take an active or passive approach to investing and building a nest egg. The approach investors choose may depend on their goals and personal preferences.

Effect of Debt-to-Equity Ratio on Stock Price

This metric weighs the overall debt against the stockholders’ equity and indicates the level of risk in financing your company. The D/E ratio can be skewed by factors like retained earnings should you choose xero over quickbooks or losses, intangible assets, and pension plan adjustments. Therefore, it’s often necessary to conduct additional analysis to accurately assess how much a company depends on debt.

What are gearing ratios and how does the D/E ratio fit in?

Essentially, equity is an investment in the company and assets are owned in order to generate operating revenue. It gives a fast overview of how much debt a firm has in comparison to all of its assets. Because public companies must report these figures as part of their periodic external reporting, the information is often readily available. As you can see, company A has a high D/E ratio, which implies an aggressive and risky funding style.

Why You Can Trust Finance Strategists

It’s also important to note that interest rate trends over time affect borrowing decisions, as low rates make debt financing more attractive. Additional factors to take into consideration include a company’s access to capital and why they may want to use debt versus equity for financing, such as for tax incentives. Put another way, if a company was liquidated and all of its debts were paid off, the remaining cash would be the total shareholders’ equity. The debt-to-equity (D/E) ratio is a metric that shows how much debt, relative to equity, a company is using to finance its operations.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Many companies borrow money to maintain business operations — making it a typical practice for many businesses. For companies with steady and consistent cash flow, repaying debt happens rapidly. Also, because they repay debt quickly, these businesses will likely have solid credit, which allows them to borrow inexpensively from lenders.