Accounting for Treasury Stock: Cost Method and Par Value Method

If the company intends to retire the repurchased shares, these methods cannot be used to account for the shares as no treasury stock will exist. This method assumes that options and warrants are exercised at the beginning of the reporting period, and a company uses exercise proceeds to purchase common shares at the average market price during that period. Treasury stock transactions have no effect on the number of shares authorized or issued. Because shares held in treasury are not outstanding, each treasury stock transaction will impact the number of shares outstanding. When stock is repurchased for retirement, the stock must be removed from the accounts so that it is not reported on the balance sheet. The balance sheet will appear as if the stock was never issued in the first place.

- The value attributable to each share has increased on paper, but the root cause is the decreased number of total shares, as opposed to “real” value creation for shareholders.

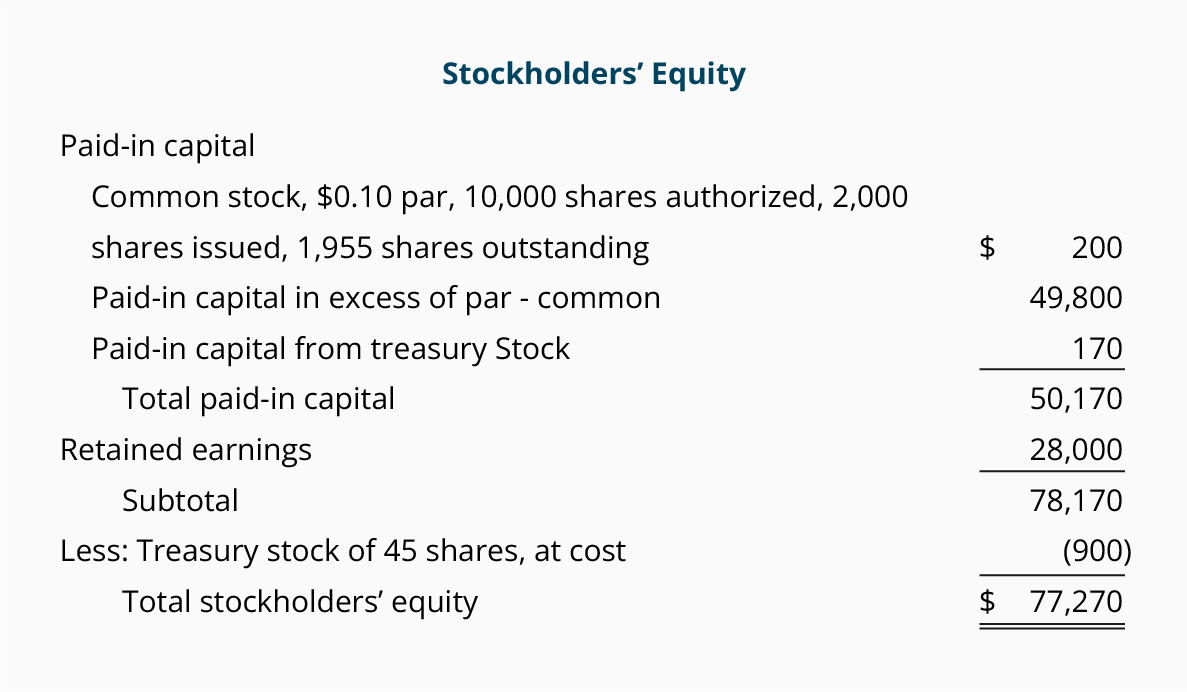

- Treasury stock is not considered an asset; it is a reduction in stockholders’ equity.

- Each share of the company’s common stock is selling for $25 on the open market on May 1, the date that Duratech purchases the stock.

- The percentage of profits or losses attributable to a single partner is decided when the partnership agreement is signed.

- In the last part of the formula, the number of shares repurchased is deducted from the total potential shares issued to calculate the net dilution, which is completed for each of the three option tranches.

Company Website:

By purchasing shares from stockholders, the corporation can use them, for example, as part of the compensation to executives without having to go through the legal difficulties of amending the Charter to allow additional shares to be issued. With the exception of the possible impact on the amount of legal capital, these shares are in substance the same as unissued shares and should generally be accounted for under that assumption. The formula for calculating the net dilution from each tranche of options contains an “IF” function that first confirms that the strike price is less than the current share price. If we were to ignore the dilutive impact of non-basic shares in the calculation of equity value, we would arrive at $200mm. Furthermore, the EPS formula divides the net income of a company by its share count, which can be either on a basic or diluted basis.

How Treasury Stock Is Recorded

The exclusion of these types of securities into common equity would mistakenly inflate the earnings per share (EPS) figure. The Treasury Stock Method (TSM) is used to compute the net new number of shares from potentially dilutive securities. The following table presents a financial statement disclosure made by American Broadcasting Companies related to treasury shares. On the cash flow statement, the share repurchase is reflected as a cash outflow (“use” of cash). Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Create a Free Account and Ask Any Financial Question

An alternative method of accounting for treasury stock is the constructive retirement method, which is used under the assumption that repurchased stock will not be reissued in the future. Under this approach, you are essentially reversing the amount of the original price at which the stock was sold. The remainder of the purchase price is debited to the retained earnings account. By multiplying the fully diluted shares outstanding by the current share price, we calculate that the net impact of dilutive securities is $2mm and the diluted equity value is $202mm. Once treasury stock is calculated, it’s listed as a contra-equity account in the shareholders’ equity section of the balance sheet. It represents shares that the company has issued but are no longer outstanding because they have been repurchased.

Treasury Stock in Diluted Share Count Calculation

If the treasury stock is reissued at a price below cost, the account used for the difference between the cash received from the resale and the original cost of the treasury stock depends on the balance in the Paid-in Capital from Treasury Stock account. The transaction will require a debit to the Paid-in Capital from Treasury Stock account to the extent of the balance. If the transaction requires a debit greater than the balance in the Paid-in Capital account, any additional difference between the cost of the treasury stock and its selling price is recorded as a reduction of the Retained Earnings account as a debit.

What Are Retired Shares?

The simplest way for companies is to reacquire any outstanding shares of the company directly from the market. The company may also choose to reacquire its shares through a tender offer to its shareholders. In this method, the company offers it shareholders to sell their shares back to the company at a specified date and price. Any shareholders that are willing to take up the offer submit their application for their shares to be reacquired. Companies may also choose to give a Dutch auction tender offer to their shareholders.

Treasury stock is also acquired in order to retire the shares of one or more stockholders. At an extreme, a few influential stockholders may decide that they would like exclusive control over the corporation by buying out the others. PwC refers to the US member firm or one of its subsidiaries or affiliates, qualifying relative and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. The reason is that the denominator (the share count) has increased, whereas its numerator (net income) remains constant.

A treasury paid-in capital account is also either debited or credited depending on whether the stock was resold at a loss or a gain. Due to double-entry bookkeeping, the offset of this journal entry is a debit to increase cash (or other asset) in the amount of the consideration received by the shareholders. That said, treasury stock is shown as a negative value on the balance sheet and additional repurchases cause the figure to decrease further.

If the amounts or circumstances are material, then it is unlikely that account titles will convey all the information that the statement user needs. Adtalem Global Education is not responsible for the security, contents and accuracy of any information provided on the third-party website. Note that the website may still be a third-party website even the format is similar to the Becker.com website. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.